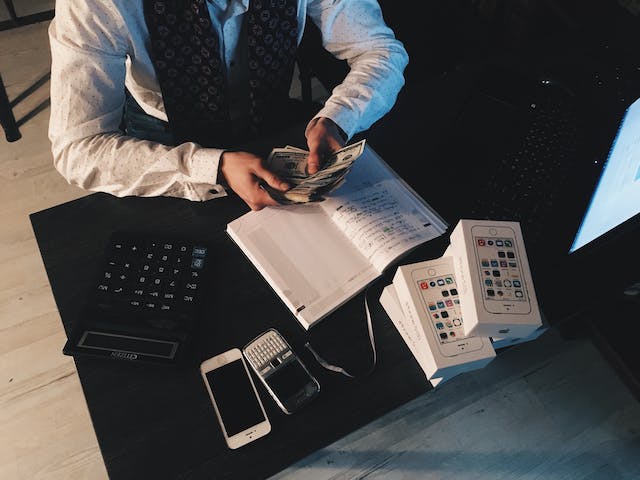

Here are the top 3 reasons your business needs a top business accountant

Running a business is one of the most difficult challenges in the world and needs to be done in a planned and strategic manner. If you are a business owner, then you need to make sure every single angle of your business is looked at and strategized to gain the optimal results. One thing a lot of people do when it comes to the finances of the business, is to develop a financial or accounting department internally. At the start of a business, this is not going to be the most practical or sensible decision to make. This is why you need to check out how to outsource to a good accountant that will help you transform your business along the way. Working with an accountant is a decision that a lot of people make and for this, you need to check out a very well know and highly qualified, well – seasoned business accountant. Here are the top 3 reasons your business needs a top business accountant now and in the future!

The accountant has expertise and the knowledge

Business accounting is a specialized area that requires the right kind of proficiencyand understanding of financial concepts, tax laws, and sector-specific accounting operations. Your financial records will be accurate, up to date, and will adhere with all rules and regulations thanks to the years of expertise and education that they bring to the table. Accounting for businesses involve managing various financial processes like bookkeeping, payroll, tax preparation, and reporting. Their expertise goes beyond just record-keeping while also offering insightful advice on many forms of financial planning. Businesses can use their knowledge and experience to make smart decisions that promote growth and increase revenue. An experienced accountant for business tax Hallam can assist businesses in maximizing their tax planning, ensuring they take full advantage of all allowable credits and deductions while maintaining compliance with tax regulations.

Expert accountants know how to time manage and be efficient

Internally handling accounting work within a business can be a time and resource waste. Small business entrepreneurs frequently find themselves juggling many tasks, from operations and customer service to sales and marketing. Taking on accounting tasks is only going to add to this burden, which can result in mistakes and cause you to ignore other important areas of your company. Outsourcing to a business accountant allows business owners to concentrate on their key strengths and spend their time and resources on operations that genuinely grow their companies. Accounting tasks can be outsourced to an accountant for quick work, timely financial reporting, and good decision making.

Strategic financial planning is guaranteed with an accountant

A key component of implementing long-term financial strategies is a business accountant. They are able to develop solid and realistic financial plans that fit with the objectives and vision of the company. This include creating budget plans, creating realistic financial goals, and defining key performance indicators to push your business and company forward.

-

Tagged KS