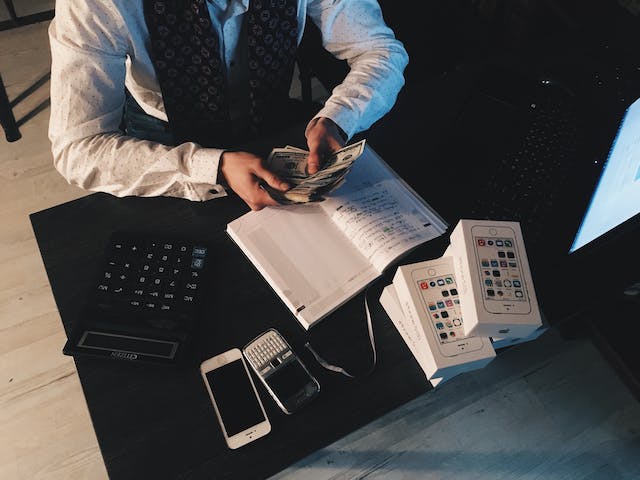

Tips for Choosing a Small Business Accountant

As a small business owner, it is important to manage your finances effectively. Some of the tasks related to this you need to do are bookkeeping, financial planning and navigating tax laws. You can obtain the assistance of a small business accountant for these tasks so that you can make the best choices for your business.

There are many companies

That you will come across such as Oliluca small business accountants. But before you start choosing a company, you should have a good idea of your financial needs. Maybe you are looking for help with financial forecasting or bookkeeping. Some business owners are looking for help with tax preparation specifically. Or you may have several tasks that need help with. Once you have a good idea of the requirements, you can then start looking for a small business accountant that offers these services and have the right expertise to guide you in the right direction. Check whether they have the relevant experience. You can check whether they have worked with small businesses in the same industry as yours and in the same scale. This will give them a unique perspective on the challenges you face. This also allows them to provide you with tailored advice. Ask them about their credentials and qualifications. This information can be found on their official website.

You can also ask other small business owners for recommendations on accountants.

You can ask other industry peers and mentors regarding this. A quick Google search will give you a list of companies that provide specialised services regarding this. When asking for more information about the recommended company, make sure to ask about their communication style, reliability and competence. Online reviews and ratings can also be very helpful in narrowing down accounting services. Make sure to read feedback from previous clients to get an idea of their experience and whether the accountant is the right fit for your business. They will need to have more than just expertise on the field when deciding about compatibility with your business. They should be able to communicate clearly with you and listen to your concerns. In the initial consultation with potential small business accountants, you can see whether they have a genuine interest in your business and if they have the capacity to become a trusted advisor.

Certain financial concepts can be complex

And it requires a skilled accountant to explain these in an understandable manner. You can gauge their communication skills at the initial consultation. Also, ask them about how they prefer to communicate with you and their availability. The technological proficiency of the small business accountant should also be taken into account. They should be familiar with common small business accounting software so that the accuracy of their services is improved. This also allows them to streamline processes, saving time and money. While it is important to consider the cost factor, make sure to focus on the value they can bring to your business. They will be able to minimise the tax liabilities of your company and maximise deductions.

-

Tagged KS